Case Studies

Case Study 1

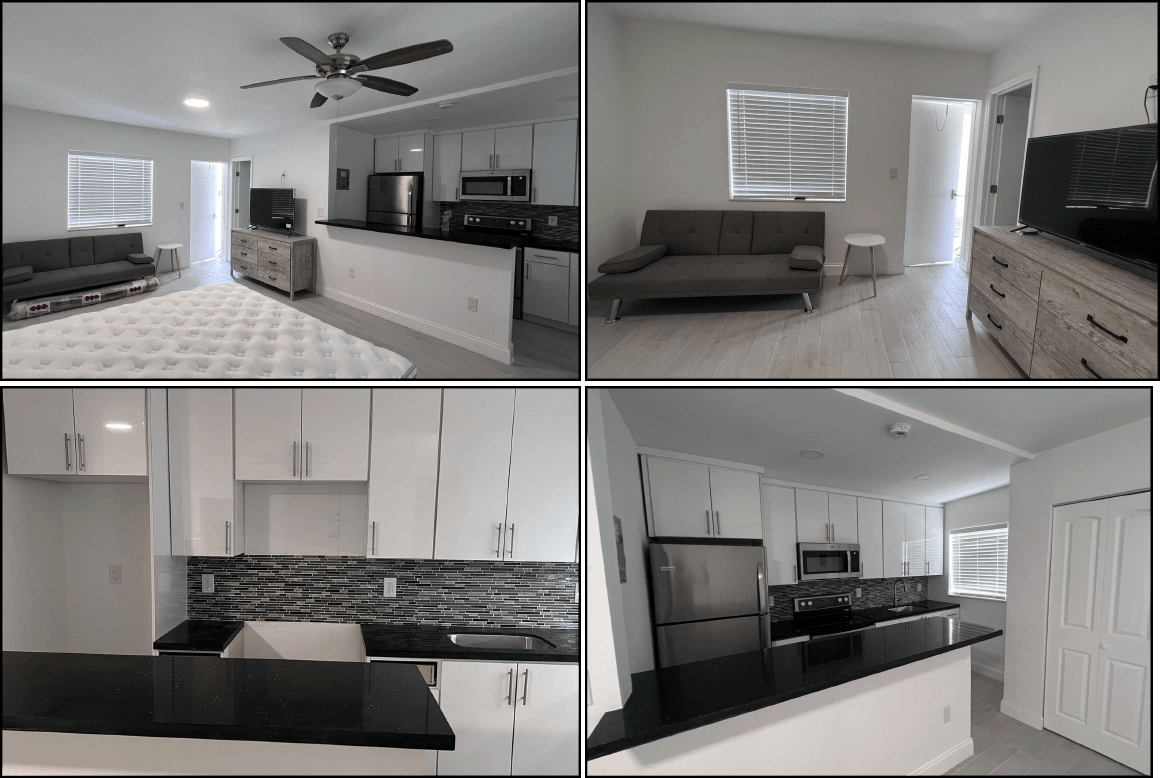

- Broward County, Florida

– Purchased in June 2022 for $1.9M

– Renovations included a new roof and unit upgrades

– Stabilized within 16 months

– Fair Market Value: Approximately $2.7M

– Expected IRR: 36%

– Acquired a distressed property with potential for significant value addition.

– Conducted essential renovations to enhance property appeal and functionality.

– Achieved full occupancy and stabilized rental income within a short period.

– Identified high-potential retail location for fashion swimwear.

– Implemented a rigorous training program for store managers.

– Streamlined inventory procurement from approved suppliers to ensure quality and efficiency.

– Leveraged economies of scale through the YN Holdings network for cost savings and operational efficiency.

Case Study 3

- New York and Miami

– Flagship stores in Miami Beach (opened Nov 2021) and New York City (opened Dec 2023)

– Projected to gross over $6M in 2024

– Inventory grew to over $6M

– Online platform with over 80,000 members

– Completed a $7.5M capital raise in Oct 2023 based on a $30M valuation

– Entered the lucrative sneaker resale market with significant growth potential.

– Opened flagship stores in prime locations to establish a strong brand presence.

– Expanded inventory and enhanced online platform capabilities to attract a large customer base.

– Successfully raised capital to further expand operations and market reach.

Case Study 4

- Monroe County, Florida

– Purchased in March 2019 for $2.7M

– Renovations included infrastructure and unit upgrades

– Stabilized within 20 months

– Fair Market Value: Approximately $7.4M

– Expected IRR: 38%

– Acquired a distressed property with potential for significant value addition

– Conducted essential renovations to enhance property appeal and functionality

– Achieved full occupancy and stabilized rental income within 18 months

Case Study 5

- Monroe County, Florida

– Purchased in May 2021 for $3,850,000

– Renovations included infrastructure and building upgrades

– Stabilized within 12 months

– Fair Market Value: Approximately $8.1M

– Expected IRR: 36%

– Acquired a distressed property with potential for significant value addition

– Conducted essential renovations to enhance property appeal and functionality

– Achieved full occupancy and stabilized rental income within 18 months

Case Study 6

- Broward County, Florida

– Purchased in October 2021 for $12M

– Purchased in May 2022 for $10.5M

– Renovations included infrastructure, building and Unit upgrades

– Stabilized within 18 months

– Fair Market Value: Approximately $38M

– Expected IRR: 29%

– Acquired property with potential for significant value addition

– Conducted essential renovations to enhance property appeal and functionality

– Increased occupancy and stabilized rental income within 18 months